A study on the impact of hypothetical stakes on experimental outcomes by Jack Fitzgerald in Experimental Economics

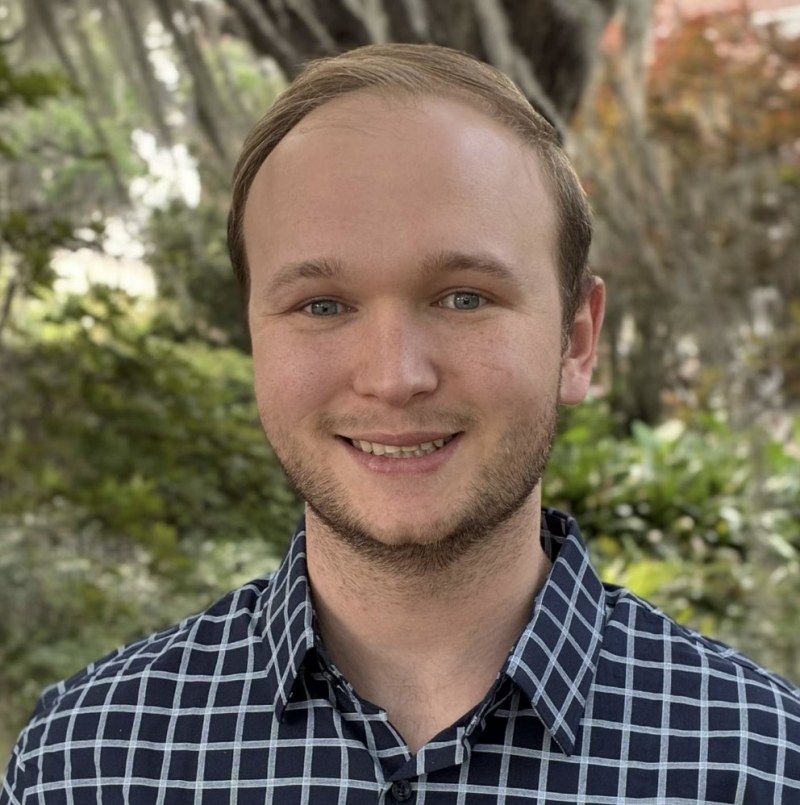

The paper ‘Identifying the impact of hypothetical stakes on experimental outcomes and treatment effects' by PhD student Jack Fitzgerald (Vrije Universiteit Amsterdam), has been published in Experimental Economics.

Abstract

Recent studies showing that some outcome variables do not statistically significantly differ between real-stakes and hypothetical-stakes conditions have raised methodological challenges to experimental economics’ disciplinary norm that experimental choices should be incentivized with real stakes. I show that the hypothetical bias measures estimated in these studies do not econometrically identify the hypothetical biases that matter in most modern experiments. Specifically, traditional hypothetical bias measures are fully informative in ‘elicitation experiments’ where the researcher is uninterested in treatment effects (TEs). However, in ‘intervention experiments’ where TEs are of interest, traditional hypothetical bias measures are uninformative; real stakes matter if and only if TEs differ between stakes conditions. I demonstrate that traditional hypothetical bias measures are often misleading estimates of hypothetical bias for intervention experiments, both econometrically and through re-analyses of three recent hypothetical bias experiments. The fact that a given experimental outcome does not statistically significantly differ on average between stakes conditions does not imply that all TEs on that outcome are unaffected by hypothetical stakes. Therefore, the recent hypothetical bias literature does not justify abandoning real stakes in most modern experiments. Maintaining norms that favor completely or probabilistically providing real stakes for experimental choices is useful for ensuring externally valid TEs in experimental economics.

Article citation

Jack Fitzgerald , ‘Identifying the impact of hypothetical stakes on experimental outcomes and treatment effects', Experimental Economics, published online January 2026, pp. 1-21, doi.org/10.1017/eec.2025.10035.